As Boston Celtics’ President Danny Ainge trades away Paul Pierce, Kevin Garnett (and Doc Rivers) to avoid a long rebuilding mode, I ponder: “What would I have done if I were Danny Ainge?”

Thinking about culture-building has become a necessity as I get older and face leadership responsibilities. The Celtics trade situation is even more interesting because I am a huge Celtics Fan and because I deduced (based on past quotes and anecdotes) that three of my heroes – Larry Bird, Bill Russell, Warren Buffett – probably would have differed with Danny Ainge on this.

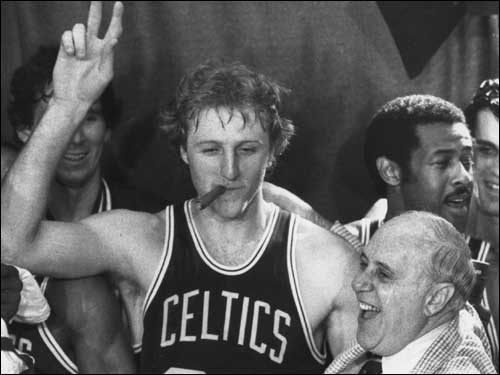

Celtics Dynasty – Red Auerbach

The Boston Celtics was/is my favorite basketball team for a long part of my life. (When Bird gets involved with Indiana Pacers, my favorite team switches between Celtics and Pacers). The Celtics won 17 NBA championships and its architect, Red Auerbach, has built a mystique culture called the Celtics Tradition. Many of its players continue to stay involved with the Celtics after retirement (By far, the Celtics have the most alumni work with the Celtics. No other team comes even close). While no one maxim can provide secrets to building championship teams (otherwise, everyone will be champions), I think the following quote by Red Auerbach comes close to summing up his secrets to building world championship teams: “I don’t believe in statistics. There are too many factors that can’t be measured. You can’t measure a ballplayer’s heart.”

I feel the same way. Great teams and organizations like the Celtics and Berkshire Hathaway have a culture in place that places a strong value in intangibles. The NBA is so full of physically skilled players that often, championships are won by the team or player who just has a bigger heart — who wants to win a little bit more, or just wants to play hurt a little bit more.

Likewise, in business, I believe the heart and the human spirit are constantly underrated by finance professionals who lump these intangibles as beta and all other statistical jargon. Oftentimes, it is the group of short-term players – such as investment bankers, VC’s and other LBO types – who look past the intangible qualities of a team the most because they have a near term goal (as in going for a quick near-term sale to another company), often leading to bad outcomes. Unfortunately, the near-term plans may not work out, and then the company is stuck with a bad team culture, which leads to cancer.

This is all business and everybody is doing it.

The biggest words I hear about NBA trades these days is “It’s all a business … everybody is doing it”. There is nothing wrong with being near term oriented, but as we all know, we should always question our assumptions and not get too carried away because everybody else is doing it. The four most dangerous words Warren Buffett warned are: “Everybody is doing it”. What is good for the Orlando Magic, may not be good for the Boston Celtics who has this mystique that seemed unbreakable. I propose to the Celtics owners, Grousbeck and Pagliuca, a theory that in the case of Boston Celtics which has a priceless moat around its goodwill and reputation, loyalty is also good for building long-term value of the Boston Celtics business. As Buffett said, “It takes a lifetime to build a reputation; it takes 15 minutes to destroy it.”

What happens to the Boston magic (that Russell, Cousy, Havlicek, Dave Cowens, Larry Bird, Kevin McHale and all the former Celtic players all refer to) after this? Does this mean Celtic players will become less loyal and play hurt less (in the playoffs) in the future? (Kevin McHale or Larry Bird played with broken foot and broken ankles in the 1987 NBA finals) What happens if the “heart” that Red focused on so much, becomes less and less. Danny Ainge has to assume that his actions may have a long-term impact on the culture of Boston Celtics. In fact, Ainge is lucky in that he may be able to milk the Boston mystique for a little while longer, thanks to Auerbach’s hard work in building such a loyal culture among the Boston Celtics.

How do you build a strong team culture? Let’s ask another person, like Larry Bird

Larry Bird proved himself to be a very capable team builder. With a small city budget, he changed the culture of Indiana Pacers and made them a worthwhile contender that took Miami Heat to 7 games this season. I observed his actions very carefully when I followed him from 2003 to 2011. He did not seem to fall for the short-term gain, but really thought long and hard about building the culture of the Pacers. The result is the Pacers are now an easy team to root for, if you like team basketball.

Last year, there was a big article about how Danny Ainge said he would have traded the Big Three of Larry Bird, Kevin McHale and Robert Parish if he were Red Auerbach back in the 1980’s. Larry Bird was asked by Bill Simmons and here is what he had to say:

Larry Bird: “On whether it would be prudent to break up the current Big 3 or even the original Big 3 of Bird, Kevin McHale and Robert Parish — as current Celtics president Danny Ainge has suggested: “I would have kept them [referring to himself, McHale and Parish]. The one thing about Red was loyalty. And that’s why I never wanted to leave there, because I always knew he had my back, he cared for me, he wanted me to do well. Obviously, he wanted me to play at a high level…. Danny [Ainge] did tell Red he should trade us right now because we don’t have much left in the tank… I was there with Danny and Red and McHale the day we were talking about that. The one thing that Danny threw in there was players’ names. The whole time I was in Boston I never heard Red mention any other players on other teams. I heard him talking about draft picks, but I never heard anything about, ‘Larry, I can trade you for this, this and this.’ He just never did that… Kevin McHales don’t come around very often. … you know, in 1987 Kevin played through a broken foot — it was actually broken and he tried to play and he’s still paying for it. So, you don’t find those types of guys anymore. Very few of them out there probably. Kevin gave his heart and soul to the Celtics and Red knew that.” (Original Source: http://espn.go.com/blog/boston/celtics/post/_/id/4689454/simmons-and-bird-talk-nba)

Bill Russell: ”I don’t care if we lose, I would not trade you for anybody else”

One of my most vivid memories of the Boston Celtics was when player coach Bill Russell (NBA’s winningest player who has 11 championship rings versus Michael Jordan’s 6) told his aging teammates in the last game (Game 7 before playing the Los Angeles Lakers in the 1969 NBA Finals) of his career: “I don’t care if we lose, I would not trade you for anybody else”. Watch this:

[youtube=http://www.youtube.com/watch?v=ue2kL5nwdYE&w=420&h=315]

Warren Buffett: “Who is going to the foxhole with me?”

People write about Buffett’s winning stock picks all the time, but you can learn more about the man by analyzing how he performed during times of crises. One of the most fascinating moments was when Warren Buffett had to take over as interim CEO of Salomon Brothers during the Treasury Auction rigging crisis in 1991. Watch Buffett in action as he speaks in front of the Senate:

[youtube=http://www.youtube.com/watch?v=O0R_9L_D2Yk&w=420&h=315]

In Roger Lowenstein’s book, “Buffett: the American Capitalist”, Buffett used the term “Who is going to the foxhole with me?” when choosing the CEO of Salomon Brothers. He looks for the “intangibles” that are not necessarily recommended by compensation consultants, but seem so obvious and just plain common sense. Consultants seem to ignore the big elephants in the room (e.g huge free ride packages such as options versus having the CEO risk their own capital in the company) and tend to focus on past track records even if the record was achieved during a financial boom or bubble in the industry’s period. Berkshire Hathaway directors are famous for not having Directors and Officers insurance. (In the USA, many board members in public companies abuse the D&O insurance to the point that shareholders are constantly ripped off. Funny, I see businessmen throwing away their common sense more in countries where the capital market is very developed. I think it is the other people’s money – the OPM syndrome. In Southeast Asia, where capital markets are not as well developed, asking CEOs to risk some of their capital is more common.)

I end this post by warning that there are no clear answers to this. I am sure Danny Ainge can come up with many reasons that are valid. I am sure Danny has a lot of short-term pressures that are much bigger than mine. Sometimes, in my work, I end up having to just go with faith and what feels right in the gut. I have to say no to seemingly great investment opportunities because the “intangibles” just “inexplicably” do not feel right. Call me old-fashioned, but I like to hope I would have acted more like Larry Bird, Red Auerbach, and Bill Russell if I were running the Boston Celtics.

P.S. My blog post does not do justice to the Celtics. If you are interested, pick up Bill Russell’s book, “Red and Me”, or Red Auerbach’s books such as “Red On and Off the Court” or Larry Bird’s “Drive” to understand the mystique culture of Boston Celtics.